Executive Summary

Chevron is preparing to drill its first exploration well in Block 5 offshore Suriname later this year 2025, marking a significant step in the company’s expansion within South America’s emerging petroleum frontier. This strategic move positions Chevron and its investors at the forefront of a potentially transformative discovery in one of the world’s most promising hydrocarbon regions.

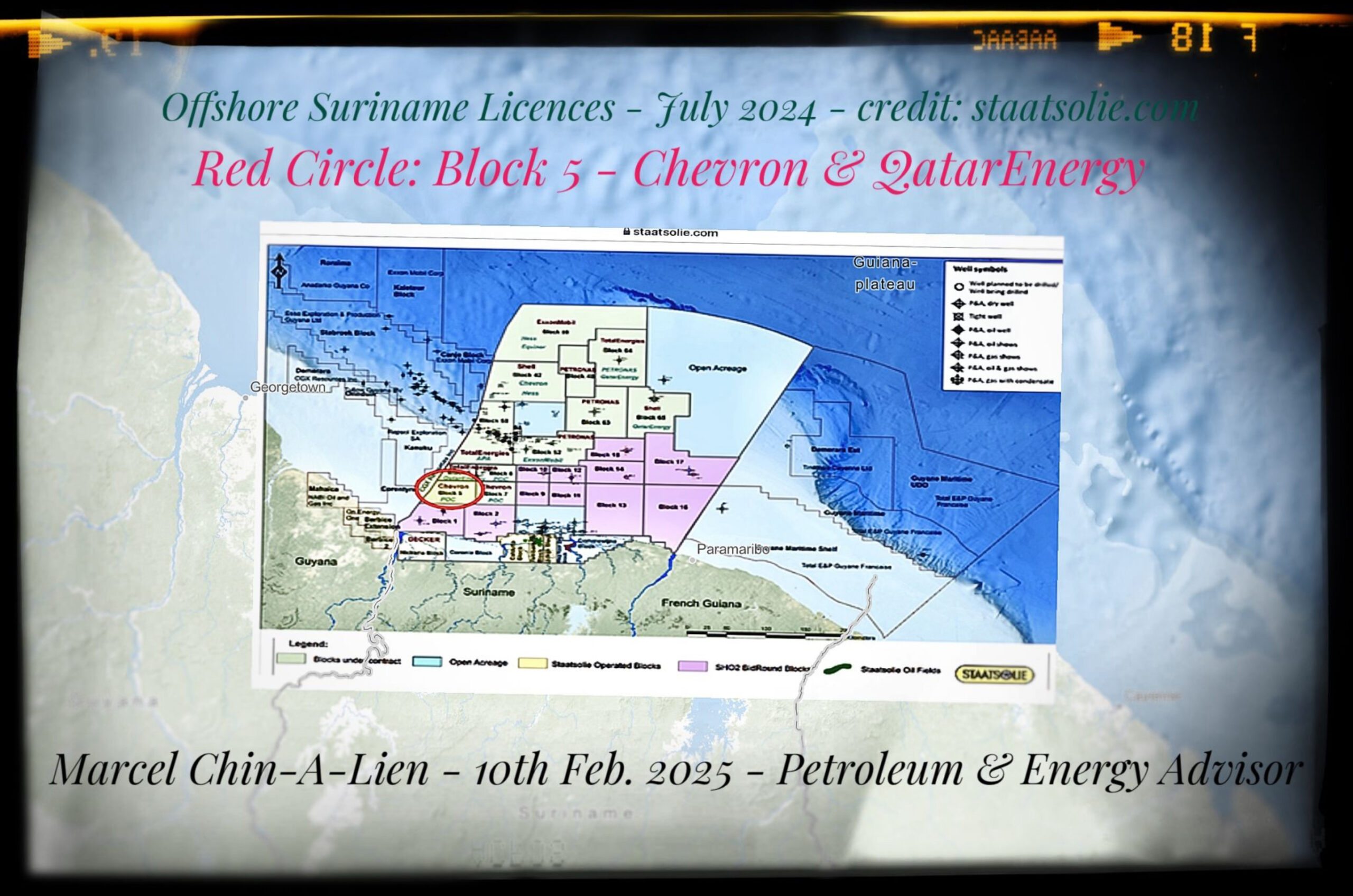

Geographic and Geological Context

Block 5 is strategically positioned in the western segment of Suriname’s shallow offshore area, spanning approximately 2,235 square kilometers. Located just 75 kilometers from the coastline, the block benefits from exceptionally favorable water depths of only 30-45 meters—a significant operational advantage compared to deep-water exploration projects.

This location is particularly intriguing when viewed within the broader geological context of the Guyana-Suriname Basin. The basin has demonstrated world-class potential through multiple significant discoveries since 2015, establishing itself as one of the most productive new petroleum provinces globally.

The Golden Lane Question

A critical geological consideration for Block 5 is its position relative to the “Golden Lane”—the prime geological trend where companies like Apache, Total, and ExxonMobil have made their most significant discoveries. While Block 5 sits outside the core of this trend, this positioning presents both challenges and opportunities:

- Overflow Potential: The block may contain hydrocarbon accumulations that have migrated from the core Golden Lane, potentially creating substantial satellite reservoirs.

- Heavier Crude Characteristics: Similar to discoveries in the nearby Kanuku Block in Guyana (operated by Tullow and Repsol), I anticipate encountering moderately heavier, partially biodegraded petroleum with an API gravity lower than the 32° API light sweet crude found in ExxonMobil’s Liza field.

Partnership Structure

Following Shell’s strategic exit from the project, Chevron has assembled a robust partnership to share risk and expertise:

- Chevron: 40% stake (Operator)

- QatarEnergy: 20% stake (acquired July 2024)

- Paradise Oil Company (Staatsolie subsidiary): 40% stake

This balanced partnership structure combines Chevron’s technical excellence and operational expertise with QatarEnergy’s financial strength and Staatsolie’s local knowledge and government relationships.

Commercial Advantages

The shallow water depths (30-45 meters) present substantial commercial advantages:

- Development costs typically much lower than deepwater projects

- Shorter time-to-production timeline

- Reduced technical complexity in drilling and production operations

- Greater flexibility in production system selection

These factors significantly improve the economic resilience of any discovery, allowing for profitability even at moderate oil prices.

Risk Assessment

Prudent investors should consider several risk factors:

- Geological Risk: Block 5’s position outside the established Golden Lane means higher geological uncertainty than some competing opportunities.

- Oil Quality Concerns: The potential for heavier, biodegraded crude could impact recovery rates and processing costs.

- Shell’s Exit: Shell’s decision to divest their interest warrants careful consideration—though such exits often reflect portfolio rebalancing rather than specific project concerns.

Considerations

When evaluating this opportunity, one should ask him/herselve:

- Does the favorable cost structure of shallow-water development offset the increased geological risk?

- How does this opportunity compare to other frontier exploration options?

- What value do you place on Chevron’s technical capabilities and history of success in similar geological settings?

- Is an investment horizon aligned with the typical 5-7 year development timeline for such discoveries?

Conclusion

Block 5 represents a calculated opportunity in Suriname’s emerging petroleum story. While not without risks, the combination of shallow water economics, strategic partnerships, and proximity to proven petroleum systems creates a compelling investment case for those seeking exposure to frontier exploration with manageable downside.

The upcoming drilling campaign will provide critical data to evaluate the block’s true potential and could represent a significant value-creation opportunity for those who understand both the risks and rewards of frontier petroleum exploration.

Leave a Reply